Donald E Bowen and Jérôme P Taillard

Review of Finance, Volume 29, Issue 3, May 2025, Pages 747–777, https://doi.org/10.1093/rof/rfaf010

The 2002 NYSE/NASDAQ board independence mandates allow us to study how changes in board composition affect firm performance. The mandates required firms to have a majority of independent directors, with two paths to compliance: (1) replacing non-independent directors with independent directors or (2) “reclassifying” existing non-independent directors as independent once they met certain criteria (such as being three years removed from prior employment at the firm).

This setting allows us to compare firms that had to replace directors to achieve compliance versus those that could reclassify existing directors as independent. Since reclassification eligibility was largely predetermined by director characteristics that predated the mandate, this variation helps identify the impact of mandated board composition changes.

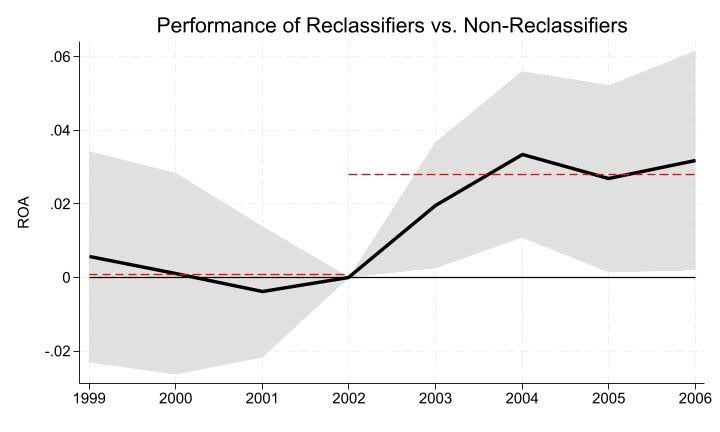

The analysis reveals that firms that had to replace directors experienced a 2.7 percentage point decline in ROA relative to firms that could reclassify existing directors. The figure below plots the triple-difference estimates over time, showing parallel trends prior to the 2002 mandate, followed by a significant outperformance of reclassifying firms. This performance gap appears driven by reduced operational efficiency – we find higher SG&A costs and lower labor productivity among firms that had to replace directors.

The results suggest that standardized board structure requirements can impose meaningful costs by limiting firms’ ability to retain directors with valuable institutional knowledge. Our evidence indicates that pre-mandate boards, on average, balanced monitoring and advisory roles effectively. Non-independent directors, particularly former employees, contribute to operational performance through their deeper understanding of the firm’s operations.

For policymakers, these findings raise questions about uniform governance mandates. While the trend toward greater board independence has continued since the 2002 reforms, our evidence highlights that insider knowledge on the board can provide meaningful benefits in certain circumstances. Balancing flexibility with independence requirements may help firms retain directors with valuable institutional expertise without compromising oversight, ensuring that governance reforms do not inadvertently hinder operational performance.

Figure 1