Sulkhan Chavleishvili, Manfred Kremer

Review of Finance, Volume 29, Issue 3, May 2025, Pages 685–710, https://doi.org/10.1093/rof/rfaf013

The Global Financial Crisis highlighted a critical asymmetry in macro-financial linkages, namely the fact that financial conditions have particularly strong effects on real economic activity in times of elevated financial distress. However, consensus on measuring overall financial distress remains elusive.

This article introduces a general framework for measuring widespread financial distress through a composite indicator, the systemic Financial Stress Index (sFSI). The sFSI combines stress indicators from multiple segments of the financial system. Its primary objective is to provide a continuous and timely measure of systemic stress, enabling policymakers to monitor the breadth, depth, and dynamics of an ongoing financial crisis in near real time.

Conceptually, the framework is grounded in standard definitions of systemic risk. Within this framework, systemic stress is defined as a state in which a representative set of market-specific stress indicators is simultaneously extremely high (extremeness dimension) and strongly interdependent (co-dependence dimension). This reflects the idea that systemic risk materialises when financial instability spreads widely across the financial system, disrupting the general provision of financial services and suppressing economic activity and employment within a short period. By design, the sFSI serves as a test statistic for the null hypothesis of no systemic stress, with the article proposing a bootstrap procedure to compute critical values for this or alternative hypotheses.

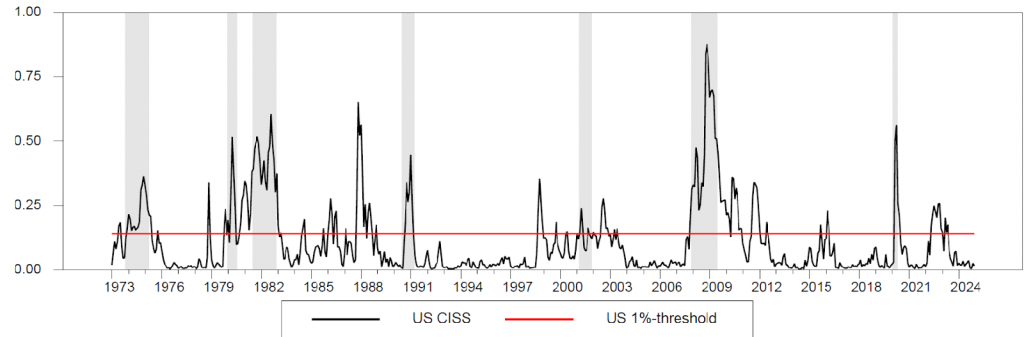

We operationalise the framework by introducing a new daily version of the Composite Indicator of Systemic Stress (CISS), a widely adopted analytical tool in both policy and academic circles. The CISS aggregates components that capture stress in the money, bond, equity, and foreign exchange markets. Components are transformed via the probability integral transform, with system-wide stress calculated as the average cross-product of transformed indicators (capturing extremeness), weighted by time-varying rank correlations (quantifying co-dependence). These correlations capture interconnectedness, contagion, or spillover effects, a critical feature of systemic risk. The CISS does not suffer from look-ahead bias, is robust to outliers, unaffected by distributional assumptions, and is simple to compute.

Empirical validation demonstrates the effectiveness of the CISS in forecasting severe downside risks to short-term growth. In quantile regressions, the CISS consistently outperforms alternative financial indicators in the lower tail of the growth distribution. It achieves a balance between predictive accuracy and statistical robustness, with no evident trade-offs. Using a mixed data sampling (MIDAS) approach, it is shown that the CISS also nowcasts downside risks to growth both in-sample and out-of-sample, making it a valuable tool for monitoring financial crises and their macroeconomic costs in real time.

The figure below shows the US CISS and a high-stress threshold estimated using the bootstrap procedure described in the article. Notably, all recessions (the shaded areas) coincide with elevated systemic stress, although the reverse is not necessarily true.

Daily updates of the CISS are available for multiple countries through the ECB’s Data Portal or standard commercial data providers.

Figure 1