Ohad Kadan, Asaf Manela

Review of Finance, Volume 29, Issue 1, January 2025, Pages 1–32, https://doi.org/10.1093/rof/rfae040

In financial markets, the value of information is a crucial factor for investors, analysts, and money managers who allocate resources to research assets. Understanding how much investors would pay for information has broad implications, from determining security analysts’ compensation to penalizing insider trading.

Our paper presents a simple yet powerful measure for estimating the value of information, even in complex markets. Building on the framework introduced by Kyle (1985), where a monopolist informed trader’s value of information is determined by the ratio of an asset’s fundamental variance to its price impact, we extend this to a more general setting. In our model, multiple investors receive imperfect signals about asset fundamentals, and each trader must account for their effect on prices. The ratio of fundamental variance to price impact still serves as a tight approximation for the value of information in this scenario.

Our theoretical contribution shows that this ratio provides a good estimate of the value of information in markets with multiple informed investors, as long as their signals are not highly correlated. This statistic can be easily estimated using high-frequency stock data, providing practical insights for both researchers and practitioners.

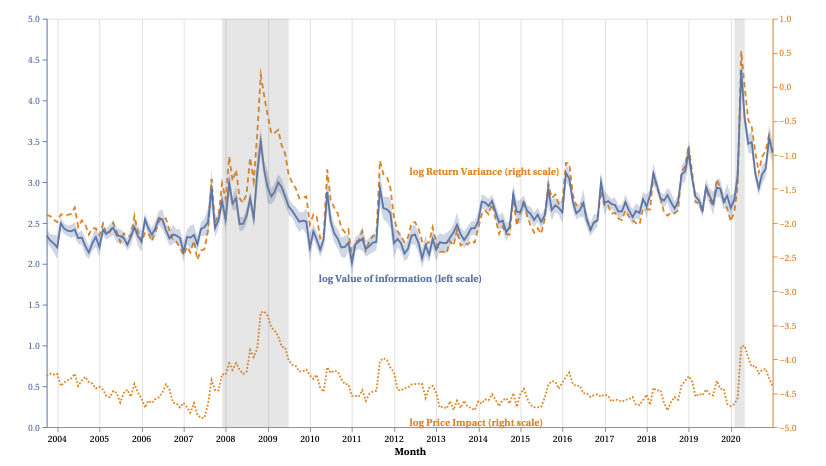

Empirically, we estimate this value of information for US-listed stocks on a daily basis over an extended sample period, leveraging intraday data. The findings indicate that the value of information spikes during periods of market turbulence. For example, the most significant increases occurred during the financial crisis of 2008 and the COVID-19 pandemic in 2020, as both periods were marked by dramatic rises in uncertainty and liquidity interventions by the Federal Reserve.

Additionally, we observe that the value of information is higher for large-cap, growth, and momentum stocks compared to smaller or value-oriented stocks. Despite their generally lower volatility, larger stocks’ superior liquidity makes information more valuable for strategic traders.

This paper is the first to empirically estimate the value of information for strategic investors who internalize their price impact. By developing and estimating this simple and intuitive measure, our research opens new avenues for understanding the value of asset-specific information. Our results also contribute to ongoing debates about market efficiency, the role of private information in capital allocation, and the dynamics of trading during financial crises.

We believe that these insights will be valuable for both academic researchers and practitioners. From an academic perspective, this work highlights the importance of liquidity and volatility in determining the value of information. Practitioners can use this measure to better understand the profitability of information acquisition, making it relevant for asset managers, data vendors, and regulatory bodies focused on market transparency and insider trading enforcement.

Figure: Liquidity and the Strategic Value of Information

Notes: The solid line is the monthly information value averaged over stocks and days surrounded by its 95 percent confidence interval, based on time-clustered variance estimates. The value of information is annualized variance divided by price impact and reported in millions of dollars. The mean and standard deviation of the value of information are estimated with the delta method to alleviate measurement error of this ratio. The log information value equals log annualized return variance less log price impact, so we also report the mean of log annualized return variance (dashed line) and the mean of log price impact (dotted line). Shades indicate recessions.