Yield curve momentum

Markus Sihvonen

Review of Finance, Volume 28, Issue 3, May 2024, Pages 805–830, https://doi.org/10.1093/rof/rfae003

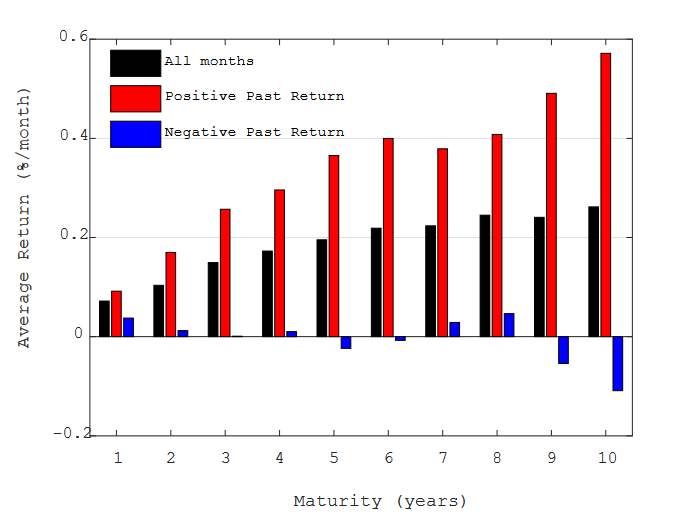

I find that past month Treasury bond returns predict bond returns also in the following month. This time series momentum pattern is easiest to detect at shorter maturities but exists also for longer maturities. The momentum cannot be attributed to measurement error or other trivial frictions and can be profitably exploited e.g. using futures contracts.

This momentum can be attributed to a change in the level factor of yields, even though the level of the level factor cannot explain the results. The FOMC drift, i.e. a short term drift pattern in yields after Fed meetings, can also explain some but not all of the observed momentum.

Standard term structure models imply a so called spanning condition: no variable should predict bond returns after controlling for information in the term structure today. While these models can in principle generate momentum due to autocorrelation in model factors, they hence predict that the predictive ability of past return vanishes after controlling for sufficiently many yields. Such full spanning holds also in standard macrofinance and behavioral models.

I find that past returns predict future returns also controlling for current yields. Moreover, they do so conditional on macroeconomic variables. This violation of the spanning condition poses challenges for standard theoretical explanations for momentum.

I instead propose a model that can explain both the documented momentum and the violation of the spanning condition. In the model agents face a complexity constraint and ignore longer term dependencies in model factors.

Figure 1

The figure shows the mean excess returns for different maturity bonds both for the full sample and in subsamples following positive and negative past month returns. The sample is from August 1971 to December 2019.