The lead article in Volume 21, Issue 2 of the Review of Finance is “Credit Ratings Across Asset Classes: A Long-Term Perspective” by Jess Cornaggia and Kimberly Cornaggia of Penn State, and John Hund of Georgia.

Credit ratings are a critical feature of bond markets. They affect at least three interrelated outcomes:

- Bond Pricing. Higher-rated bonds are associated with lower yields. This reduces the cost of debt for companies, but also the return earned by investors.

- Investor Demand. Even if low credit ratings are compensated for by higher returns, the credit rating may affect investors’ demand for bonds. Risk considerations may lead to investors shunning low-grade bonds even if high-yielding. Regulation discourages insurance companies (and, to a lesser extent, pension funds) from holding bonds that are below investment grade (i.e. below BBB with Standard & Poor’s (“S&P”) and Baa with Moody’s).

- Regulation. Since Basel II, the risk-weighting of a bond, and thus the amount of equity the investor must use to finance its purchase, is decreasing in its credit rating.

Thus, the accuracy of credit ratings is key to well-functioning bond markets. Moreover, both the major rating agencies, S&P and Moody’s, claim that ratings are consistent across asset classes. For example, the President of S&P testified before the House of Representatives in 2011: “We have always had one scale, a consistent scale that we have tried to adopt across all our asset classes.” The Managing Director of Moody’s wrote to the SEC: “[C]redit ratings … serve as a point of reference and common language of credit that is used by financial market professionals worldwide to compare risk across jurisdictions, industries and asset classes, thereby facilitating the efficient flow of capital worldwide.”

If true, consistency has numerous benefits. Investors can compare the yields offered by bonds in different asset classes with the same rating, when deciding which to buy. Regulators can apply risk weights based solely on the bond’s rating, rather than a more complex system where the weight also depends on the bond’s asset class. Given the importance of consistency, the SEC published a request for comments that asked, among other things, whether ratings are “comparable across asset classes.”

However, this paper shows that this is not the case. One of its main strengths is to use a variety of different analyses and a long time-series of Moody’s data to allow them to nail down this conclusion. Some of the results are summarized below:

| Default frequency of A-rated bond | Accuracy ratio | Transitions (% downgrades – % upgrades) for A-rated bond | Downgrade hazard versus corporates | Upgrade hazard versus corporates | |

| Corporates | 0.51% | 0.40 | 12.39% | 1 | 1 |

| Municipals | 0.00% | 0.44 | -48.11% | 0.594 | 2.890 |

| Sovereigns | 0.00% | 0.36 | -17.71% | 0.618 | 2.068 |

| Financials | 4.13% | 0.30 | -2.25% | 2.525 | 1.730 |

| Structured Finance | 26.97% | 0.16 | 36.39% | 1.876 for ABS[1] | 0.418 for ABS |

Default Frequency

If ratings were comparable, then the probability that a bond defaults should depend only on its rating, rather than its asset class. However, the authors find significant variability in the default rate across asset classes. For example, no municipal or sovereign A-rated bonds defaulted over 1980-2010, but 26.97% of structured finance tranches (SF) defaulted.[2] In turn, there was significant variability within SF, with no defaults in public finance and high defaults in asset backed securities (ABS), residential mortgage-backed securities, and collateralized debt obligations.

Accuracy Ratio

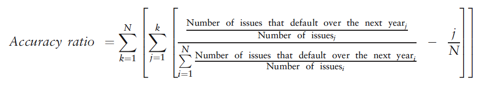

If ratings are accurate, then lower ratings should correspond to more frequent defaults. The accuracy ratio is a single summary statistic that captures the accuracy across all different rating levels – in contrast to default probabilities which can only be compared for a single rating level. (Technically, it is the area between the cumulative distribution of default frequencies across rating levels and the straight line that would exist if ratings were randomly assigned). It is calculated as follows:

where i, j, and k correspond to a rating level. Again, we see substantial variability across asset classes. Echoing the default probability results, the ratio is highest for municipals and lowest for structured finance (particularly CDOs).

Transition Probabilities

Accuracy ratios only measure how a given rating predicts default relative to other ratings, but not the accuracy of the overall rating schedule. A high accuracy ratio could result from all ratings underpredicting default. In addition, it does not tell you the direction of any inaccuracy, i.e. whether ratings are too high or too low. The next analysis thus studies transition probabilities – i.e. the relative frequency of future downgrades versus upgrades. Consistent with earlier results, it suggests that ratings were significantly over-optimistic in SF and under-optimistic for municipals.

Hazard Rates

While the default frequency analysis is conducted for each individual rating level, the accuracy ratio is a single number that summarizes default across all rating levels. Similarly, while the transition probability analysis is conducted for each individual rating level, the hazard rate is a single number that summarizes the likelihood of future changes across all rating levels. Using a Cox proportional hazard model, and using corporates as a benchmark, financials and ABS are significantly more likely to be downgraded, and municipals significantly less. The results are generally the opposite for upgrades. Splitting the sample into different time periods, the differential rating changes are greatest during – but not exclusive to – the crisis period of 2007-10.

One concern is that the different upgrade and downgrade frequencies may be due to different bond characteristics. Perhaps there was an unexpected change in economic conditions (such as the financial crisis) and so, if structured finance happened to be most frequently issued just before the crisis, this would explain the frequent downgrades. The authors show that the results continue to hold in multivariate regressions that control for when the bonds are issued, as well as several bond characteristics such as size, coupon, and maturity.

Potential Explanations

The authors consider various potential explanations for their results. They suggest that the results are most likely to arise from conflicts of interest due to the “issuer pays” model – i.e. issuers, not investors, pay for credit ratings and so agencies may have incentives to offer optimistic ratings. This is because the direction of errors “follows the money” – asset classes receive the most optimistic rating when they generate the highest revenue for agencies. For example, in 2005, structured finance rating revenues were 2.5 that of corporate bonds, which reversed by 2009. These potential conflicts have important implications for policy. Indeed, the paper was referenced by the SEC in its release on new rules for Nationally Recognized Statistical Rating Organizations (“NRSROs”), its NRSRO Final Rule, and its report to Congress; and statements by SEC Commissioners Kara Stein and Michael Piwowar on finalizing ratings rules related to Section 938 of Dodd-Frank. Finally, the paper demonstrates that failure to adequately distinguish credit risk across asset classes (in the IRB capital requirements established in the Basel framework and in capital charges set by the NAIC) can be costly to financial institutions (by requiring too much capital) or dangerous (by requiring too little).

The authors argue that their results are not consistent with alternative explanations:

- Opaque bonds are hard to assess, and so there will be a greater dispersion of ratings across S&P and Moody’s. Thus, if the issuer cherry-picks the highest rating, optimism will results from opacity rather than intentional bias. However, the authors find least bias in municipals and sovereigns, despite them being particularly opaque due to variations in accounting standards.

- Investors subject to regulatory constraints pressure agencies to distort ratings – for example, insurance companies may pressure agencies to give BBB rather than BB ratings so that they can hold them. However, this would explain systematic inflation across all asset classes in all times, but the authors find that inflation is specific to certain asset classes in certain times.

[1] This figure refers to ABS not primarily backed by real estate (i.e. do not include residential or commercial mortgage-backed securities).

[2] While the authors have exhaustive data for most asset classes, they only have a sample of data for municipal bonds. The zero default rate refers to the bonds in their sample.