Dual Ownership and Risk-Taking Incentives in Managerial Compensation

Tao Chen, Li Zhang, Qifei Zhu

Review of Finance, Volume 27, Issue 5, September 2023, Pages 1823–1857, https://doi.org/10.1093/rof/rfad007

This paper examines how institutional investors’ simultaneous holding of the same firm’s equity and bonds affects the setting of executive compensation. Financial economists have long recognized that shareholders and creditors have divergent preferences over a firm’s risk-taking and its policies, such as investment and capital structure (Jensen and Meckling 1976, Myers 1977, Smith and Warner 1979). An important agent in this shareholder-creditor conflict is firm managers, who decide corporate policies. Since the incentives of managers are not automatically aligned with the incentives of shareholders, shareholders write managerial contracts to increase this alignment.

In standard textbooks, we often consider managers, shareholders, and creditors as separate entities, and the received wisdom is that creditors have no role in setting managerial compensation. However, we have recently seen the rise of shareholders who simultaneously hold the same firm’s bonds through their affiliation with financial conglomerates. Such investors are dubbed “dual holders. For these dual holders, their objective is to maximize the total value of their portfolio debt and equity. Compared to pure equity holders, dual-holding shareholders have less appetite to incentivize managers to take more risks. Hence, we posit that there should be a negative relationship between dual ownership and the use of option-based compensation.

Using a sample of U.S. public companies between 2006 and 2016, we show that the presence of one additional significant dual holder decreases the usage of option grants (as a fraction of total annual compensation) by 0.75 percentage point, or 4 percent of the sample-average option payments. It also lowers CEO vega (compensation sensitivity to stock return volatility). The level of dual ownership is positively correlated with the use of CEO “inside debt”, which aligns CEO payoff with creditors.

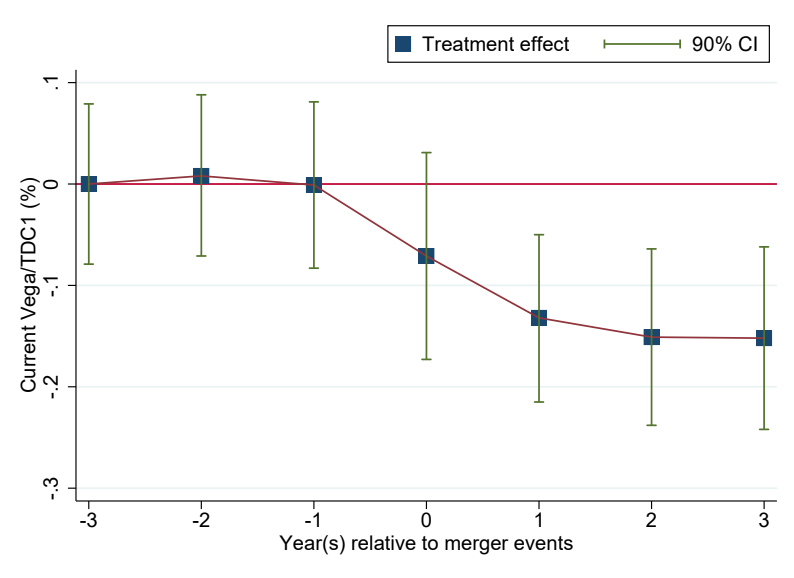

To mitigate endogeneity concerns, we examine mergers between financial institutions that shock the level of dual ownership. A difference-in-differences analysis with matched control firms reveals that firms that gain significant dual holders from financial company mergers reduce their use of option grants by 1.9 percentage points after the merger.

We further examine shareholder voting records on executive compensation proposals to shed more light on the mechanism. The voting analyses show that mutual funds from a significant dual-holder family are 2.8 percentage points more likely to dissent in an option-increasing proposal, as compared to pure equity funds. When the proposals intend to reduce the use of options, significant dual holders are 1.9 percentage points more likely to vote in favour of the proposal. These findings suggest that shareholder voting is one of the mechanisms that dual holders use to influence executive incentives.

Our findings shed new light on how institutional shareholders shape corporate governance structure and executive compensation. We highlight that financial institutions themselves may have divergent interests in how they set managerial incentives because their portfolio value is also exposed to the debt of the company.