A Wake-Up Call Theory of Contagion

Toni Ahnert, Christoph Bertsch

Review of Finance, Volume 26, Issue 4, July 2022, Pages 829–854, https://doi.org/10.1093/rof/rfac025

Financial contagion is an important phenomenon contributing to the spread and severity of financial distress. Forbes (2012) distinguishes four different, but not mutually exclusive, channels of contagion: trade, banks and financial institutions, portfolio investors, and wake-up calls. Goldstein (1998) informally introduced the notion of wake-up call contagion, whereby a crisis in one region is a wake-up call to investors that induces them to re-assess and inquire about the fundamentals of other regions. Such a re-appraisal of risk can lead to a contagious spread of a financial crisis across regions or to other financial institutions.

Despite the popularity of the wake-up call contagion channel, including among policymakers, there has been little theoretical work. Our paper offers a theory to fill this gap. How can there be contagion even if there is no discernible exposure across countries or financial institutions ex-post, that is at the time of the contagious spread of a crisis? How do the magnitude of the wake-up call contagion effect and the demand for information during the re-appraisal of risk depend on the degree of ex-ante exposure across countries or financial institutions?

We develop a global coordination game of regime change with two regions that move sequentially. A financial crisis comprises a currency attack, a bank run, or a debt crisis and occurs when enough investors act against the regime in their region by attacking a currency peg, withdrawing funds from a bank, or refusing to roll over debt. We define contagion as an increase in the probability of a financial crisis in one region due to a crisis in the other region.

In our model regional fundamentals are linked via the exposure to a common macro shock, which captures common vulnerabilities and institutional similarities of regions. The wake-up call of observing a crisis elsewhere induces investors to acquire costly information about the actual exposure to the common macro shock.

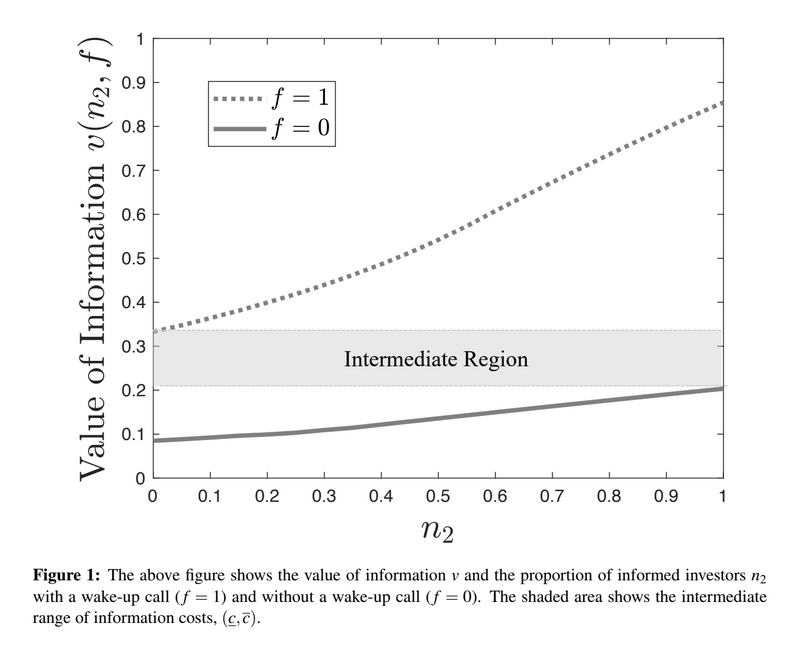

Our first main result is that investors have a higher incentive to acquire information about the common macro shock after observing a crisis in the first region. Thus, for intermediate information costs, the shaded area in Figure 1, investors choose to learn only after a crisis—a wake-up call. In this case, an investor’s benefit of tailoring its attack decision with the help of better information about the realized macro shock is highest.

Our second main result is to isolate the wake-up call component of contagion. We show that contagion can occur even if all investors learn that the macro shock is zero, meaning that the second region has no ex-post exposure to the first region.

Our third main result is to derive a novel testable implication that may inform future empirical work. Information acquisition about the exposure to aggregate or market-wide shocks increases in the extent of ex-ante exposure across regions. We encourage future empirical work on this implication and discuss some directions.

Figure 1