Disastrous Defaults

Christian Gouriéroux, Alain Monfort, Sarah Mouabbi, Jean-Paul Renne

Review of Finance, Volume 25, Issue 6, November 2021, Pages 1727–1772, https://doi.org/10.1093/rof/rfaa042

Recent events suggest that the default of a systemic entity per se may very well constitute a disaster in itself. Indeed, since its inception, the largest drop in the University of Michigan Consumer Sentiment index took place in September 2008, the month when Lehman Brothers went bankrupt. Similarly, the existence of systemic entities is at the core of novel regulations on Systemically Important Financial Institutions.

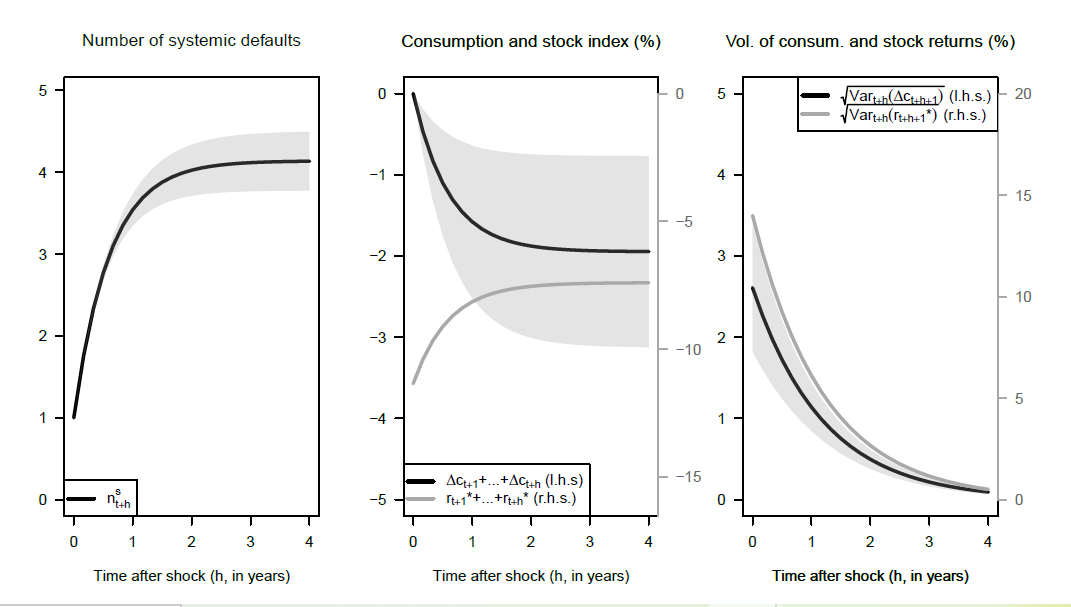

In this paper, we propose an asset-pricing framework where the default of some entities – called systemic – may have disastrous economic effects. Our paper builds on the growing literature that develops the view that a large part of aggregate fluctuations arises from idiosyncratic shocks to individual firms. In the model, the default of each systemic entity can affect consumption; moreover, such an event can be the source of default cascades. When they materialize, new defaults are likely to reinforce the initial drop in consumption and to contribute to further defaults. The model therefore accommodates amplification mechanisms.

To our knowledge, the present study constitutes the first attempt to measure the macroeconomic influence of contagious corporate defaults. This information is extracted from the joint dynamics of consumption and of the prices of disaster-exposed market instruments. Our contribution is in proposing a tractable asset-pricing model that entails disastrous firms, and in bringing such a model to the data. The model tractability, which is instrumental for our study, allows us to explore the importance of our two key mechanisms (i.e. contagion and macroeconomic effect) in accounting for the joint dynamics of consumption and asset prices.

The empirical application, which is conducted on euro-area data spanning the period from January 2006 to September 2017, demonstrates the ability of our model to capture a substantial share of the joint fluctuations of consumption growth, stock returns and stock and credit derivatives, both in tranquil and stressed periods. Specifically, our estimation involves prices of derivatives written on (i) the EUROSTOXX50 index, one of the main benchmarks of European equity markets, and (ii) the credit portfolio underlying the iTraxx Europe main index, including synthetic CDOs of different maturities and seniority levels. Our estimation procedure assigns all 125 constituent entities of the iTraxx index – the most liquid European investment grade credits – as systemic. We deduce estimates of the influence of systemic defaults on consumption. Our results suggest that the default of a systemic entity is expected to be followed by a 2% decrease in consumption within two years, accounting for contagion effects.

Figure: Responses to an unexpected default of a systemic entity