What Does Stock Ownership Breadth Measure?

James J. Choi, Li Jin, Hongjun Yan

Review of Finance, Volume 17, Issue 4, July 2013, Pages 1239–1278, https://doi.org/10.1093/rof/rfs026

What happens to future returns when large numbers of investors open new positions in a stock? One view is articulated by Michael Lewis in his classic memoir Liar’s Poker: “The first thing you learn on the trading floor is that when large numbers of people are after the same commodity… the commodity quickly becomes overvalued.” An opposing view is the theory of Chen, Hong, and Stein (2002): In a market with short sales constraints, future returns are low when relatively few investors have long positions in a stock, because that means there is a lot of negative news missing from the stock’s price.

In our paper “What Does Stock Ownership Breadth Measure?,” we show that both views have merit, depending on the population over which you are counting investors.

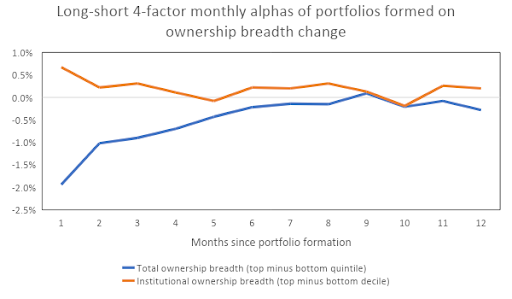

Using a random sample of investor-level holdings data from the Shanghai Stock Exchange from 1996 to 2007, we show that an increasing number of investors holding a stock predicts extremely low future returns for that stock. (Retail investors are the dominant driver of this investor count.) The annualized difference in four-factor alphas between the highest and lowest quintiles of ownership breadth change is –23% in the month after portfolio formation, with a t-statistic of 9.7. A statistically significant return difference between the quintiles persists for five months after portfolio formation.

On the other hand, if we count the number of institutional investors who hold a stock (weighting this count by portfolio value to de-emphasize the large number of Chinese institutions that hold portfolios worth less than $100,000—these are probably non-financial companies), we find that an increasing number of investors with long positions is associated with high future returns. The annualized difference in four-factor alpha between the highest and lowest deciles of institutional ownership breadth change is 8%, with a t-statistic of 2.6. This return difference is statistically significant only in the first month after portfolio formation.

While it is true that institutions profit when they trade against retail investors, the above results are not merely a manifestation of this phenomenon. When we control simultaneously for changes in the fraction of a company owned by institutions and changes in ownership breadth, only ownership breadth change remains a statistically significant predictor of returns.

In sum, when many sophisticated investors establish a new position in a stock, this is good news for the stock’s future returns. But when many unsophisticated investors do the same, the smart move is to flee that stock.