Financial Loss Aversion Illusion

Christoph Merkle

Review of Finance, Volume 24, Issue 2, March 2020, Pages 381–413, https://doi.org/10.1093/rof/rfz002

Loss aversion has been frequently documented in psychology and economics, with the conclusion that losses loom larger than gains by a magnitude of about two. In finance, loss aversion is suggested to explain, for instance, the equity premium puzzle and stock market participation.

In the evaluation of gains and losses, one has to distinguish between anticipated and experienced outcomes. Most experiments on gambles or lotteries focus on the trade-off between anticipated gains and losses. However, this implies that people are able to correctly forecast the hedonic impact of gains and losses. In contrast, recent evidence suggests that people’s ability to cope with losses is much better than they predict (Kermer et al., 2016).

Using a unique dataset, Christoph Merkle tests this proposition in the financial domain. In a panel survey of investors from a large bank in the UK, participants state subjective ratings of anticipated and experienced returns. In a time period of frequent losses and gains in investors’ portfolios, he examines how the subjective ratings behave relative to expected and experienced portfolio returns. To this end, several potential reference points investors might use are defined.

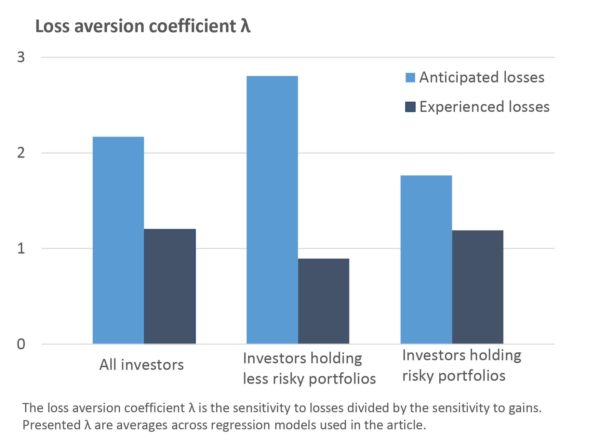

The results demonstrate that loss aversion is strong for anticipated outcomes. From regressions of subjective ratings on expected returns, a loss aversion coefficient of about 2.2 is inferred for a reference point of zero. This means that investors react twice as much to negative expected returns as to positive expected returns. However, when evaluating experienced returns, the loss aversion coefficient decreases to about 1.2 and is statistically indistinguishable from one (loss neutrality). Investors do not react more strongly to losses than to gains when they are reflecting about their past portfolio performance. The loss aversion they show ex ante seems to be partly or fully an affective forecasting error.

The findings have practical implications for investing behavior. While loss aversion is a legitimate part of people’s preferences, the documented financial loss aversion illusion represents an inconsistency in how a loss is viewed at different points in time. If investors systematically overestimate their personal loss aversion when thinking about financial outcomes, their investment decisions will differ from what is justified by their actual experiences. In particular, they will invest in less risky assets than would be optimal from an ex post perspective and will avoid potential losses unless they receive a substantial compensation. Indeed, investors with less risky portfolios in terms of volatility or assets are found to be more loss averse. However, this higher loss aversion is not backed by their loss experience as they do not react differently to losses compared to investors who bear higher portfolio risk.

Figure 1