Stefan Avdjiev, El?d Takáts

Review of Finance, Volume 23, Issue 5, September 2019, Pages 993–1029, https://doi.org/10.1093/rof/rfy030

We demonstrate that currency networks in cross-border bank lending have a significant impact on the size, distribution and direction of international monetary policy spillovers.

The combination of exceptionally low interest rates and unconventional monetary policies implemented by advanced economy central banks in the aftermath of the Global Financial Crisis has generated a heated debate about cross-border monetary policy spillovers, focusing on the impact of interest rates in major currencies on global financial conditions, and on the possible transmission channels.

We take advantage of the newly available dimensions in the enhanced IBS in order to conduct a more granular empirical examination of the international risk-taking channel of monetary policy. More concretely, we utilise the newly-available data dimensions in the enhanced BIS international banking statistics to examine the 2013 US Fed taper tantrum episode as an example of a major US monetary policy shock, which had a large impact on global cross-border flows.

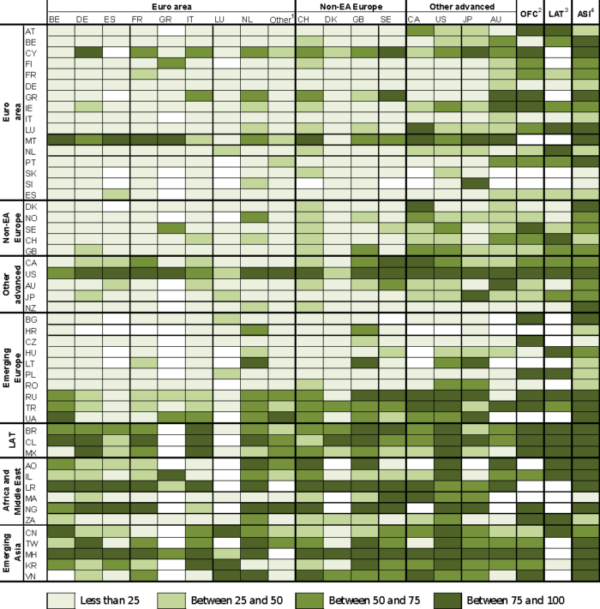

We start by mapping currency networks in cross-border bank lending. We identify two large currency networks. The dollar network accounts for around one-half of all outstanding global cross-border bank claims. The euro network, which is primarily concentrated in the euro area and in emerging Europe, is responsible for around one-third of global cross-border bank lending. The other currency networks, among which the largest is that of the Japanese yen, are much smaller than the dominant two. Furthermore, we find evidence of strategic complementarity: in given a borrower-lender pair the decisions taken by both, other borrowers and other lenders, seem to affect the currency composition of cross-border bank lending.

We obtain three main empirical results. First, a higher bilateral US dollar share on the eve of the 2013 taper tantrum was associated with a lower growth rate of cross-border bank lending to emerging markets during the taper tantrum. Second, the effect of the US dollar share was positive for lending to the United States: a greater bilateral US dollar share was associated with smaller declines (or greater increases) in lending to the US. Finally, the degree of exposure to US dollar lending had no significant impact on flows to advanced economies outside the United States.

US dollar share in cross-border bank lending in Q4 2014

By nationality of lending bank (columns) and residence of borrower (rows), in per cent